1, 2, 10? Or better not at all? In M&A it’s sort of a gamble. A gamble whether to hire advisors, because the payoff is uncertain. A gamble in terms of sharing proprietary knowledge as advisors are commonly viewed upon as hired gun, and that comes with trust issues if you are not careful. But then again, there is knowledge in numbers. so Killian McCarthy of Groningen U and Arjan Groen as former M&A partner at EY Parthenon ran our analysis.

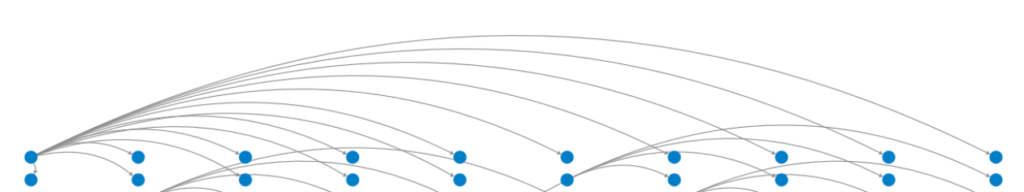

An analysis of market reactions to 10,000 U.S.-based acquisitions found that firms with a single advisor outperformed those with none — but firms which retained two or more advisors performed worse than those with just one. Through a series of interviews with industry experts, we identified four factors driving this effect, as well as six strategies to help executives maximize the value-add of working with multiple advisors. Ultimately, we noted that that while their default incentives and routines sometimes make collaboration challenging, working with multiple advisors can still add substantial value when they’re managed with an eye toward teamwork and long-term results.

Thank you Harvard Business Review for featuring our article, and hence in for those interested in the full article please check it out here at the source:

https://hbr.org/2022/12/research-how-many-ma-advisors-do-you-really-need